Welcome to the fourth edition of the Carnival of Pecuniary Delights! I’m excited to be hosting this week! Thank you to everyone for submitting such great posts.

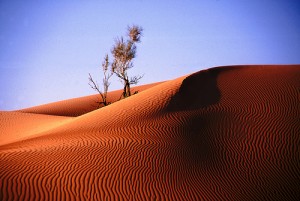

Yesterday we celebrated all things Earth and green living, so I thought it would be appropriate to extend the celebration one more day by featuring some beautiful photos of the planet in this week’s Carnival. Here we go!

Editor’s Picks

Simplified Financial Lifestyle shares the basic list of financial habits you must break. If you’re just getting started in the frugal/personal finance world, these are some of the most common habits that you should work on tackling first.

Good Financial Cents shares some tips for managing money while deployed. Saving money during a deployment sounds like a fantastic way to make the most of a difficult situation.

Momma’s Blog offers some great ideas for work at home jobs. Whether you’re a stay at home mom or job hunting after a layoff, these are some good options for bringing in a little extra income.

M is for Money offers a simple guide for investing without a lot of money. You don’t need a lot of money to invest if you do it the right way.

Personal Finance

Budgets are Sexy gives his take on some of the top personal finance magazines.

Greener Pastures discusses money and kids from a lighter perspective with her humorous post on tooth fairy inflation. When I was a kid, teeth were worth a dollar. They’ve doubled in value since then!

Financial Highway offers a reminder of the importance of life insurance in financial planning even for the young and healthy, and a simple guide for getting the right coverage.

6Bubbles takes a look at the difference between strategy & tactics in personal finance. Coming up with a game plan is always the first step to saving money, getting out of debt, or planning your financial future.

Prime Time Money discusses the idea of “bad financial products.” Education is the best way to keep yourself out of a bad financial situation.

Tough Money Love weighs the options for how to respond if a family member asks for a loan.

Bible Money Matters reminds us of the importance of health insurance even if you’re healthy. We lived without health coverage for 8 months, and I shudder to think what could have happened. We’ll never go without it again!

Spiffy Links suggests a financial mission statement to help you get on track and plan your finances.

Kids & Money at About.com has some great ideas for summer jobs for kids. Now is the best time for your kids to start saving for college and beyond. I wish I had taken advantage of my rent-free summers to save more!

Money Young offers tips for buying your first car. It’s tempting to get something flashy, but keep in mind that 5 years is a long time when you’re making high loan payments.

Personal Finance Journey

Domestic Cents shares her financial story. She’s just beginning her personal finance journey, but the biggest steps are the first ones.

Taking Charge is celebrating her first year of living frugally. Congratulations to her!

Money Management

The Happy Rock asks: can you earn the right to stop budgeting? Should budgeting end when you’re out of debt, or is that a recipe for disaster?

Personal Finance Software Reviews offers a review of the BudgetMap software, new budgeting software that functions like a high-tech checkbook.

The Digerati Life compares the pros and cons of different banking options. Keeping your money safe and sound is more important than ever, and these are all practical, safe options. This thorough breakdown will help you determine the right option for you.

Fiscal Fizzle suggests a cash-only diet to plug the leaks in your spending.

Frugal Living

Check out my friends, Silk Plants Direct, for fake palm trees* to create a tropical ambiance in your home or office!

Pay Less for Food shares baby steps for reducing grocery costs.

Man vs. Debt suggests tapping your social networks to buy and sell used items. You never know what your neighbor may need (or what they don’t need that they might be willing to sell for cheap!)

Do You Dave Ramsey? discusses the ultimate get-out-of-debt car — an old beater with lots of personality and no payments.

Free Money Finance says you don’t have to save every penny.

Christian Personal Finance offers a guide to selling on eBay.

Blessings in Bargains shares her simple reasons why she doesn’t buy many toys for her kids. Kids learn high expectations for toys and gifts. If they’re never given the opportunity, they’ll always be happy with less.

Hundred Goals urges you to stop being a slave to spending and debt and break free.

Frugal Luxury deconstructs the contents of a frugal freezer.

Turbo Tax offers an educational learning community where you can get informed and share with tax experts, so when it’s time to file your tax return again, you will be savvy to numerous deductions and tips that can save you serious dollars throughout the year.

Debt & Credit

Passive Family Income warns of hidden fees on credit cards. He was paying every month for a service he didn’t need. Have you checked your statements for hidden charges?

Paycheck Chronicles makes the case for separate credits for spouses. I think it’s important for spouses to build separate credit histories to build on their credit history together.

Debt Free Adventure shares a formula for determining the real value cost of your debt by calculating interest payments.

Canadian Finance offers tips for building credit or restoring your credit history after mistakes. A good credit score is crucial in this economy.

Investing

FIRE Finance explains the Rule of 72 for investing. It’s a simple concept that can make smart investing a lot easier.

My Dollar Plan offers the 2009 Roth IRA and Roth 401k limits for those of you who want to get an early start on your retirement investing for the year.

The Smarter Wallet shares a handy tool for charting the stock market for smarter investing.

Go To Retirement explains how to use a health savings account for tax-free retirement investing.

Economy

Bargaineering offers a rundown of the Making Home Affordable Mortgage Refinance & Modification Program. A must read if you’re upside down in your mortgage and looking to refinance.

*This link is an advertisement.

Thanks for hosting the carnival this week!

Ray’s last blog post..Dividend Investing-Understanding Dividend Basics

Thanks for the link!

I submitted this to Tip’d & PFBuzz and will like to it in my original article.

Thanks again,

Matt Jabs aka DebtFREEk!

Matt Jabs’s last blog post..Free Fitness – Skip the Gym Membership & Fix Up Your Bicycle

Pingback: Tips For Buying Your First Car | Money Young

Pingback: Reduce Monthly Bills / Lower Monthly Expenses - Trash Edition | Debt Free Adventure!

Thanks so much for including my article this week!

pfincome’s last blog post..PFI Weekly Updates – April 22 (2009)

Pingback: Hundred Goals After 100 Days « Hundred Goals

Thanks for hosting and including my article. Beautiful photos.

Nicki at Domestic Cents’s last blog post..The Deception In Getting Ahead

Great job… thanks for including my article and thanks for hosting!

Dave

Do You Dave Ramsey?’s last blog post..Goal Setting – Household Goals (part 9)

Pingback: Nice Car, what’s its name? | Do You Dave Ramsey?

Thanks for the mention and doing such a wonderful job at hosting the carnival :). Best wishes ahead.

Cheers,

FIRE

FIRE Finance’s last blog post..FREE YNAB Pro Giveaway

Thanks for hosting this week’s carnival and including my article. Glad you enjoyed it.

Pingback: Book Authors Among Us: Finance Books By Bloggers

Pingback: Weekly Blog Reviews April 20- See-Saw Edition | Financial Highway

Pingback: Friday Links | The Canadian Finance Blog

Pingback: Total Money Makeover Audio book giveaway

Pingback: What’s Sizzling? - April 24th Edition > Fiscal Fizzle

Pingback: Software Reviews Featured on Finance Carnivals | Personal Finance Software Reviews

Pingback: Good Reads: Caught A Smile : Domestic Cents

Pingback: Weekend Reading: Links Of The Week 4/25/09 | Man Vs. Debt

Pingback: Blessings in Bargains · Why I Don’t Buy (Many) Toys for My Kids

Pingback: -> Monday Roundup And Link Love! | Bible Money Matters

Pingback: QuickHits: Swine Flu Edition | Prime Time Money

Pingback: Ride The Yield Curve With Bonds | Good Financial Cents by Jeff Rose Certified Financial Planner

Pingback: PFI Weekly Updates - April 28 (2009) — Passive Family Income

Pingback: Carnival of Pecuniary Delights No. 4: Living Green & Saving Green Edition | Carnival of Pecuniary Delights

Thanks so much for hosting, Karen! I apologize for taking so long to get over here to comment and to post up the announcement at the carnival site. I totally meant to submit to this edition but have been feeling a little “blah” myself the past 1-2 weeks. :p

Great job and I love the pictures!

Penelope

Penelope @ Pecuniarities’s last blog post..Cup-o-Cakes & Tup-o-Cakes: Easy, Frugal Portable Desserts

Pingback: Link Round-up - Reader Purge Edition | Do You Dave Ramsey?