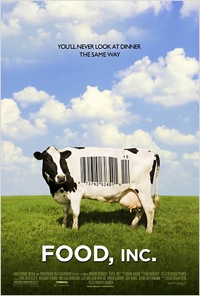

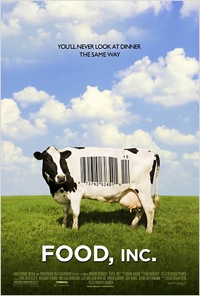

Weekend before last, Tony and I saw the documentary “Food Inc.” for free on his campus. It was an incredibly well produced, enjoyable film, even for people who aren’t into documentaries. But it scared the crap out of us.

Weekend before last, Tony and I saw the documentary “Food Inc.” for free on his campus. It was an incredibly well produced, enjoyable film, even for people who aren’t into documentaries. But it scared the crap out of us.

I won’t go into gory details here. I do recommend watching it, but if you’re squeamish you might want to read about the issues on the website instead. The scenes inside the hatcheries and “farms” are pretty brutal. I’m not particularly squeamish, but it was hard for me to take.

I’ve never really liked the idea of something dying so I can eat, but I’ve never been a vegetarian either. This movie almost pushed me there, not just because I feel guilty, but because I have serious concerns about the sustainability of current farming practices, the effects on our environment and our health.

So. Where am I going with this? I have a point, I promise.

My husband and I decided to try a halfway approach to organic and sustainable food. We’ve always bought organic produce when we can. We shop in season and try to buy locally, which is good for the environment and for our budget. Organic meat is just so expensive. Our solution is to buy the expensive organic meat — only less of it.

This week at the grocery store, we bought a whole organic chicken (marked down 25% because the sell-by date is tomorrow) that we’ll cook tomorrow and use in three meals. We also bought a pound of organic ground chicken that we’ll use next week because it was on sale for half price.

I left the movie feeling pretty powerless. We spend all this time trying to make the right choices for our health and the environment, and yet so many decisions about our food are made before we even have the option to buy it.

Unfortunately, this won’t change unless we’re willing to change our lifestyles — and our budgets. It means shifting the grocery budget to allow healthier food without spending a fortune. The only uplifting part of the movie is that it reminds us how much power we have as consumers. If we demand healthier food from producers, then they will deliver. And as the movie says, “We vote three times a day.” Every time you make a choice about what to eat, you’re telling food producers the type of food you want to buy. If you choose healthier foods, they’ll get the message.

After finishing our grocery shopping this week, we felt empowered. Our grocery bill was only about $5 more than normal, but we bought all organic meat and more organic, local produce than normal. By making smart choices (like buying higher quality meat only less of it or stock piling organic foods when they’re on sale), we can minimize the impact on our budget and still eat a healthier, more eco-friendly diet.

If you want to get involved, you can sign a petition here asking that school lunch programs serve healthier, more nutritious food to children. Or you can also learn more about how to change the food system.

I usually try to keep politics out of my blog, but I really believe this is a bipartisan issue. It affects our environment and, most importantly, our health and the health of our children.

Weekend before last, Tony and I saw the documentary “

Weekend before last, Tony and I saw the documentary “