Oh, health insurance. Why must you make everything so complicated?

Oh, health insurance. Why must you make everything so complicated?

By the time I got pregnant, I thought I was pretty prepared for everything. As it turns out, I was not only unprepared for the emotional and physical stress of pregnancy, but there are many logistical issues that I never considered.

Last year, I found out that when a pregnancy spans two separate calendar years (pretty common considering the majority of pregnancies last 9 whole months), you’re responsible for paying your deductible twice. It makes sense in theory, but ugh. What a pain!

I’m lucky in this regard. My due date is December 9. My new midwife (who is fantastic, by the way, but that’s another post) says it’s highly unlikely that my pregnancy will continue beyond 42 weeks. I’m committed to a natural birth, but I’m willing to discuss induction at 42 weeks. That means I will likely go into labor by December 23 at the latest. Since I’ll deliver in 2010, I’ll pay a single deductible. Whew.

It wasn’t until a few days ago that I considered the possibility of a third deductible.

According to several resources, it’s common for hospitals to issue a separate bill for the baby’s hospital care after birth. Once the baby is born, he becomes an individual, and he’ll receive separate care in the hospital. Even in a normal birth that doesn’t require a stay in the NICU (fingers crossed that we’ll avoid that nightmare), the baby will incur his own medical bills.

I also found out that depending on the insurance provider and the policy, it’s possible that the baby will require his own insurance deductible. Blerg. Again, this makes sense in theory, and I can’t believe I never thought about it. But to be fair, you never really think about insurance deductibles for newborns until you’re pregnant.

Some insurance companies include newborns under their mother’s deductible for the first 30 days. Many include the hospital stay after delivery under the mother’s deductible, but well baby care after discharge is separate. It really just depends on the insurance provider and the policy.

My individual deductible is $2,500. I’ve already met my deductible for this year with prenatal care, so I was looking forward to owing $0 after my delivery. A separate deductible for our new baby would change that. Even routine well baby care for a two-day hospital stay can add up pretty quickly. He’d likely reach his own deductible after just a couple days in the hospital, and $2,500 isn’t chump change.

As much as I hate (hate hate hate) calling my insurance company, I needed to know how they would handle my new baby’s deductible. If we were going to owe $2,500 to the hospital after the birth, I’d rather prepare for it than be hit with a surprise bill.

Of course, it’s not possible to call my insurance company and speak to a person without sitting through an impossible automated system that asks 45 questions. Half the time, the automated system doesn’t understand my responses, and I have to repeat myself four or five times. As I’m transferred from department to department, I have to answer the same questions two or three times. There is nothing I hate more than talking — out loud — to a robot. It is a complete nightmare. But I’m lucky to have health insurance at all, even COBRA, so I deal with it.

The conclusion? The baby’s hospital care will be included under my deductible. Once we’re discharged from the hospital, he will become an individual policy holder with his own deductible.

If you’re pregnant (or considering getting pregnant), I suggest you check with your insurance company to find out their policy for handling deductibles for newborns. It’s better to be prepared than surprised!

With a due date around New Year’s, I’m acutely aware of the possibility of getting hit with two deductibles- and we’re on a high deductible plan! I checked on this early on, because we were going to have to do some major saving to be ready for it, if that were the case. What we found out: My midwives bill both the prenatal care and the birth-center birth with a ‘service date’ of the birth day, so, whether it’s this year or next, all the costs will fall on one day. And, we have a ‘family deductible’- so, even if a hospital transfer happens and costs are incurred just for the care of our newborn, it’ll all fall under the same deductible.

It’s really good you’ve checked on all this, and are trying to understand how the complex insurance system works! There’s so much to figure out.

Joanna – Oh wow! What a great policy. That makes perfect sense to me. That would not have been the case for me, unfortunately. I’ve already been billed up to my deductible for ultrasounds and other “lab fees” outside of the global fee. Then of course I changed to a midwife halfway through, so my former OB charged me part of what would have been my global fee. But I’m pretty sure if I had stayed with the same OB, they wouldn’t have billed my insurance company until after the birth.

I’m glad it’ll work out for you, though! What a relief!

I’m due in mid-January with baby #3. When #2 was born, I noticed on the hospital bill that we were charged $500 each time we asked the nurses to take her down to the nursery so I could rest or shower. We pay a straight 10% out of pocket, so I’ll be saving myself $50 each time I decide to keep #3 in the room with me.

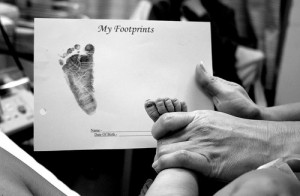

It stinks to have to think about things like insurance companies and costs when all you really want to do is cuddle with your baby.