It’s now November, which means I’m beginning my 6-month countdown to our cross-country move. Since I’m planning both the move and our trip to Europe simultaneously, I’m getting organized early. I’ve decided to keep you posted with monthly updates of how we’re preparing.

Here’s what lies ahead in the next month as we prepare to move back home:

Start clearing clutter now.

Getting rid of things takes time, especially if you want to try to sell them. We’re starting to downsize now to ensure that we’ll have less to pack, move, and store this May.

Get your resume in order.

We’re undecided about whether or not I’ll be going back to work full time. It will really depend on how much Tony earns in his job. I’ll most likely be working part time until I have a baby, and who knows how long that will be. Tony, on the other hand, is looking for full time work immediately. He’s focusing now on updating his resume, scoping out opportunities, and networking. It’s a little early to start aggressively applying for jobs, but he may send out some resumes with interest letters in the month ahead to companies with which he’s interested in pursuing a job.

Start thinking about housing.

If you’re planning to buy a home in your new city, now is the time to start looking at real estate. If you haven’t put your own home on the market, it’s definitely time to do so.

If you plan on renting, now is a good time to scope out neighborhoods or apartment complexes. Ask around if you have connections in your new city to find out which neighborhoods are safest with the best education and transportation options. If you don’t have connections, a little research online can tell you a lot about apartment complexes and neighborhoods.

We’ve already decided we want to live in the Indianapolis area. We also won’t be looking for housing right away. We might stay with family an hour outside the city. My best friend and her fiance have also offered us the opportunity to stay with them in Indianapolis for the summer. We might end up doing that so I can start working immediately, and it’ll be easier for Tony to get to interviews and look for job opportunities.

Make a moving budget, and save, save, save.

Even if you already have some money saved, you can never have too much in savings when you move to a new city. Start putting together a rough estimate for what it will cost to move your things, get situated in a new place, and cover basic living expenses until you find a job or start getting paid.

Cut your expenses now to save as much as possible in the coming months. The more money you have in savings, the less stressful your financial situation will be when it’s time to move.

What do you suggest we do to start preparing now?

Photo by ahhyeah

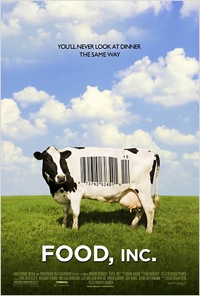

Weekend before last, Tony and I saw the documentary “

Weekend before last, Tony and I saw the documentary “