Sorry, entries for this contest are now closed. A winner has been chosen, and I will be announcing as soon as I’ve received the prize from T. Rowe Price and contacted the winner. Thanks for participating!

When I was a kid, my parents were a pretty open book. We talked about money just like we talked about everything else. My parents never kept us in the dark. We understood the financial choices they made, and they shared things with my sisters and me candidly.

When I was a kid, my parents were a pretty open book. We talked about money just like we talked about everything else. My parents never kept us in the dark. We understood the financial choices they made, and they shared things with my sisters and me candidly.

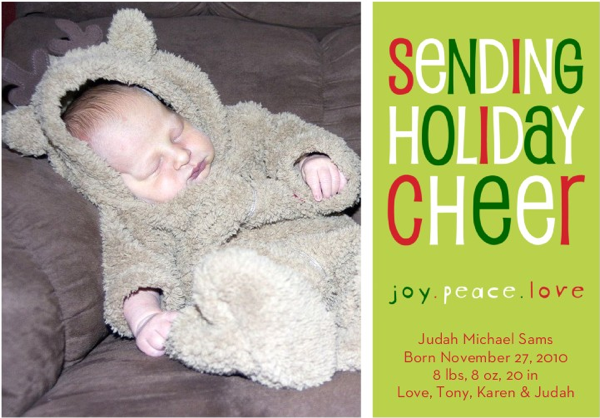

Now that I have a baby of my own, I’ve already put thought into how I’d like to educate him about money. I think it’s important for parents to talk to their kids about money from an early age. The lessons should be age-appropriate, of course, but I think we’ll start Judah’s financial education pretty early.

We plan to ask Judah to put aside a portion of birthday and Christmas money given to him by grandparents into a savings account. He’ll be allowed to make choices about how he’d like to use the money, but we’ll talk with him about the value of saving money and spending it responsibly.

I’m not sure where I stand on the topic of giving an “allowance.” My sisters and I were given an allowance off and on throughout childhood, and it was usually tied to completing certain household chores. I think kids should learn that contributing to the household by doing chores is part of their responsibility as a member of our family — not an incentive for money. However, I think there’s value in teaching kids that work = money, and if they want to earn an income, they have to work for it.

Most importantly, Tony and I plan to be open with Judah and future children about our financial situation and choices. When they’re old enough to understand, I’d like to teach them about paying bills each month and show them how much things cost. I’d like to go over the family budget with them to show them where our money goes and discuss our emergency fund, savings, and other financial choices in depth.

I want to encourage our children to work part-time after school when they’re teenagers, and give them financial responsibilities of their own like car insurance, gas, and spending money. I was given financial responsibilities as soon as I was old enough to work, and I think it taught me a lot about money management and responsible spending habits.

As part of their financial literacy campaign, T. Rowe Price asked me to write a post about talking with kids about money. According to a recent survey conducted by T. Rowe Price, they discovered that parents found it more difficult to talk to their kids about money than talking to them about dating, drugs, smoking, or alcohol. That sort of blows my mind. I think money is a topic that you can begin discussing with children at a much younger age than I would bring up those other topics.

It doesn’t have to be complicated. It can be as simple as playing “store” or “restaurant” with a young child and teaching them to exchange play money for toys or play food. The lessons can grow with your child as you discuss more complicated financial issues like budgeting, saving, and investing.

To help parents start talking about money with their children, T. Rowe Price and Disney have teamed up to launch the Great Piggy Bank Adventure, an interactive website designed for children ages 8 to 14 to teach them about important financial concepts like saving, spending, inflation, and more complicated investing concepts. In addition to the website, T. Rowe Price is also the sponsor of the Great Piggy Bank Adventure experience at Epcot Center at Walt Disney World. There, children and their parents can learn more about financial planning in a hands-on, interactive environment.

I love the idea of the Great Piggy Bank Adventure, because I think it makes financial literacy fun for kids and parents. There’s no reason to feel overwhelmed about teaching your children about money. It can even be a game!

As part of their campaign, T. Rowe Price asked me to talk to you about how you talk to your kids about money. In exchange for your participation in the discussion, you’ll be entered to win a Great Piggy Bank Adventure Flip camera provided by T. Rowe Price. Here’s how to enter:

Write a comment answering one or more of the questions below. For each question you answer, write a separate comment. Each comment will be counted as a separate entry.

That’s it! It’s easy. The winner will be chosen randomly on Friday, August 12 at 9 p.m. EST, so you have until then to enter.

Here are the questions:

- Is it easier for you to talk about drugs and alcohol than your family finances? If so why?

- Why do you think it is easier for parents to talk about drugs and smoking than family finances with their kids?

- Was the topic of money “taboo” in your family growing up?

- What advice would you give to other parents talking to their kids about the family finances?

Good luck!

Disclosure: In exchange for writing this post, T. Rowe Price provided the Flip camera for this giveaway and also provided me with a gift card for my participation. T. Rowe Price is not involved in or responsible for the outcome of this giveaway.