Photo by geishaboy500

It’s bad enough that airline tickets have skyrocketed in the past two years, but recent hikes in luggage checking fees have made travel even more expensive. Some airlines, including American, Northwest, United, and US Airways, are even charging for your first checked bag.

It’s bad enough that airline tickets have skyrocketed in the past two years, but recent hikes in luggage checking fees have made travel even more expensive. Some airlines, including American, Northwest, United, and US Airways, are even charging for your first checked bag.

Here are some tips for avoiding these excessive fees, or at least reducing their impact on your travel budget.

1. Be familiar with the airline’s policies before you buy your tickets.

Online ticket brokers like Expedia.com and Priceline.com have made it easy to compare major airlines’ prices before purchasing tickets. (Keep in mind, they also charge fees for their services, so I recommend purchasing your tickets directly through the airline.)

Unfortunately, when buying through these sites, it’s easy to forget extra add-on fees in your quest for the cheapest price. You may purchase a ticket from United because it’s $15 cheaper than Delta, but you’ll end up paying the same after you check your bag.

This handy chart from Travel Insider compares all of the checked luggage policies of major airlines as of July 2008. Be familiar with these policies, and bear in mind the length of your trip, how many bags you’ll have to check per passenger, and the likely weight of each bag. Figure all of this information into the final ticket price so you’ll have a better comparison when purchasing.

2. Avoid checking luggage all together by carrying on if possible.

According to this carry-on luggage policy chart, all of the major airlines still allow a free carry-on bag and “personal item” for each passenger. Personal items include purses, laptop cases, backpacks, etc. It should be easy to fit all of your necessities in a carry-on and personal bag if your trip is short. Take advantage of this, especially if your airline charges for your first checked bag.

The airline we’re traveling on doesn’t charge for the first checked bag, but we prefer carrying on anyway to eliminate the risk losing our luggage during a layover. Luckily for us, our trip is short. We’ll only be staying for three days. So all of our luggage will be with us for the duration of the trip.

3. Minimize your toiletries, especially for carry-on bags.

Staying in a hotel? Then you probably don’t need to worry about toiletry items like shampoo, conditioner, soap, and mouthwash. Most hotels will provide these for you. This is good news if you’re carrying on since current Transportation Security Administration restrictions limit liquids in carry-on bag.

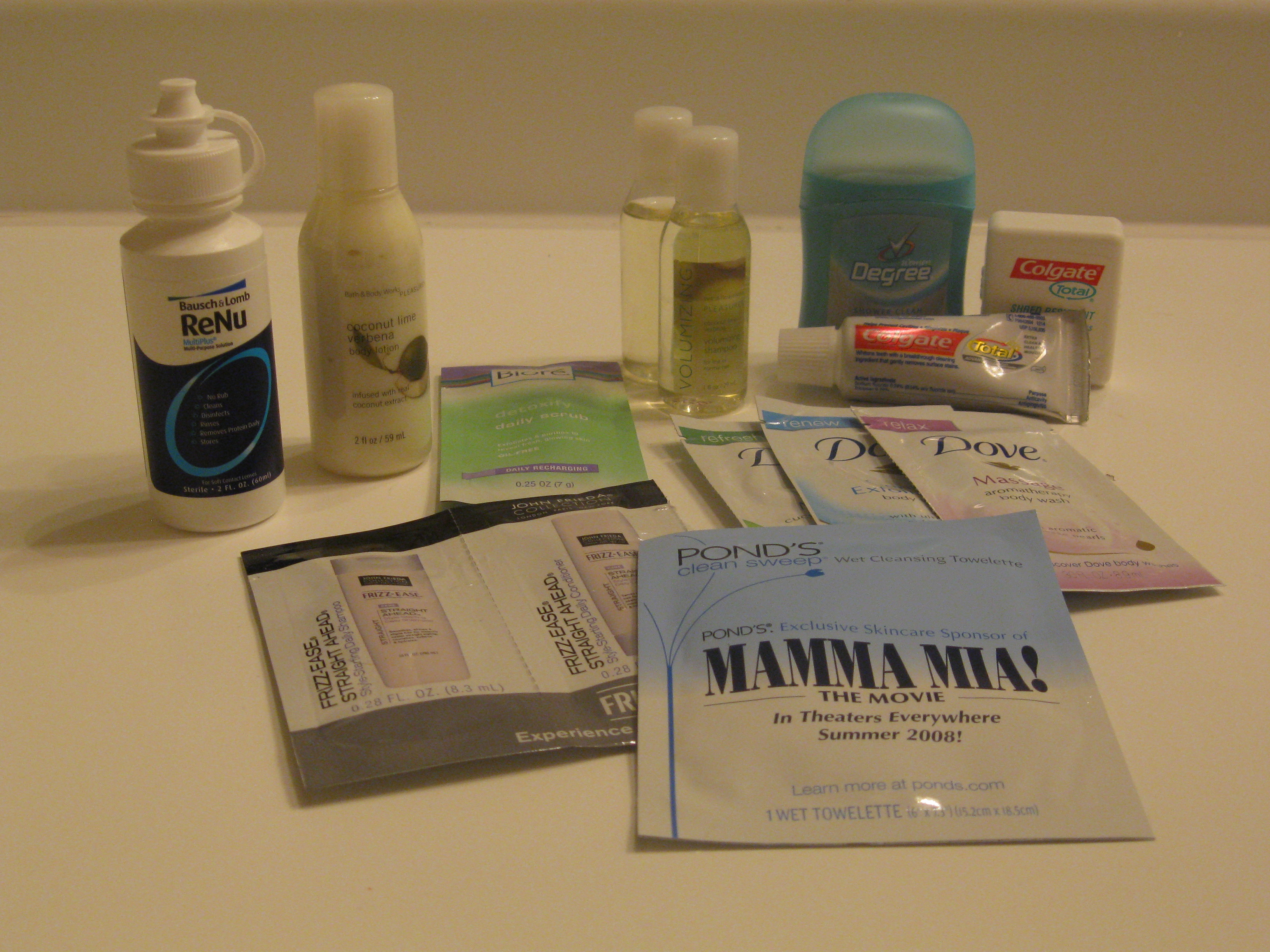

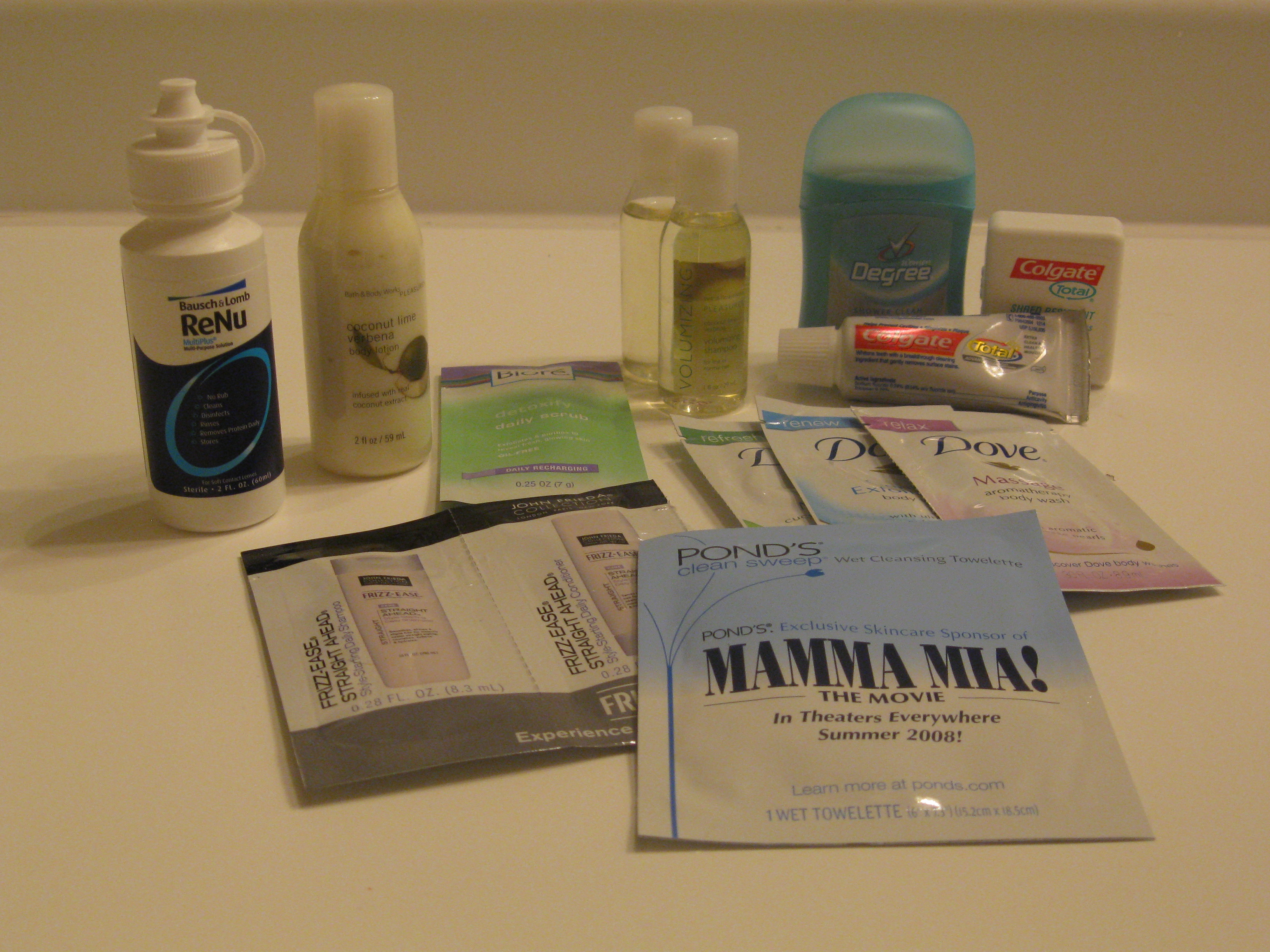

We’re staying with my sister, so we’re bringing our own toiletries. No problem for frugal folks like us. We’ve been collecting free samples for months. We also have some leftover hotel toiletries from our honeymoon. Samples easily meet the 3 oz. or less requirement for carry-ons, and they’re compact enough to fit into the TSA-approved quart-sized zipper bag. Plus, it’s fun to try some new toiletries on vacation.

Here’s three day’s worth of mini toiletries:

And look how nicely they fit in a 1-quart bag:

4. If you must check luggage, weigh your bags before you leave.

The surcharges for extra weight can cost a fortune. You can refer to this chart again for luggage weight limits and costs. Save yourself some trouble, and money, by putting your suitcase on a scale before you leave for the airport. Move some items to your checked luggage or to a backpack that you can carry on as a personal item if your bag weighs too much. If you can’t get around the extra weight, at least you’ll be prepared for the high fees when you check your bag.

5. Pack light!

This one is last on the list because, well, duh. The best way to save money on checked luggage fees is not to check luggage, even for longer trips.

If you’re very careful about how and what you pack, you should be able to get a week’s worth of necessities into a carry-on suitcase and personal bag. Notice, I said necessities. Obviously you can’t scrimp space on items like underwear and socks, but everything else is up for negotiation. Do you really need more than one pair of shoes? What about that extra sweater?

For long trips, most hotels offer coin laundries as a courtesy to guests. Doing laundry might not seem lik a fun vacation activity, but it’s certainly a lot cheaper than paying $15-$25 per checked bag. That money could go to something a lot more worthwhile on your trip, like a nice restaurant meal or a museum admission. Take that into consideration when deciding whether it’s really worth it to check your bag.

Last weekend during one of our long talks, Tony and I ended up discussing the things we’d like to do before we have children. At the top of both of our lists was a trip to Europe.

Last weekend during one of our long talks, Tony and I ended up discussing the things we’d like to do before we have children. At the top of both of our lists was a trip to Europe.